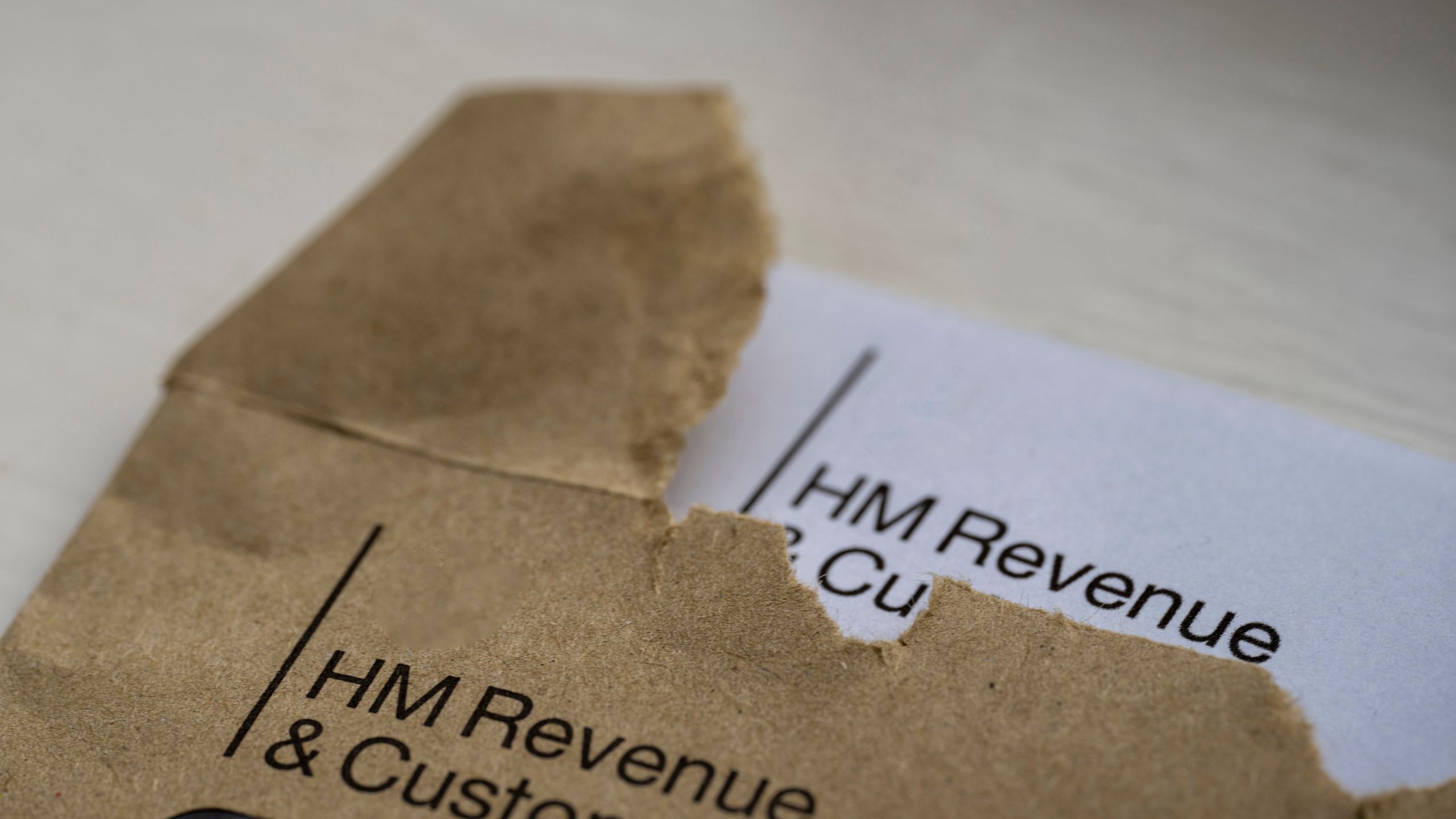

The failure to prevent the facilitation of tax evasion is a criminal offense in many countries, including the United Kingdom. Under the UK’s Criminal Finances Act 2017, companies can be held liable for failing to prevent their employees or associated persons from criminally facilitating tax evasion.

In order to be held liable, the company must have failed to take reasonable steps to prevent the facilitation of tax evasion. This means that the company must have had in place adequate procedures to prevent the criminal facilitation of tax evasion and must have been able to demonstrate that these procedures were in place and were being effectively implemented.

To prevent the facilitation of tax evasion, companies should conduct regular risk assessments to identify the risks of the criminal facilitation of tax evasion in their operations and implement appropriate controls to mitigate those risks. This might include implementing policies and procedures to prevent the facilitation of tax evasion, training employees on the risks and how to prevent them, and monitoring and reviewing the effectiveness of the controls in place.

If a company is found to have failed to prevent the facilitation of tax evasion, it can face prosecution, significant fines, as well as reputational damage. In addition, the company’s senior management may be held liable for the offense and may face prosecution.

In conclusion, the failure to prevent the facilitation of tax evasion is a serious criminal offense that can have severe consequences for companies. To prevent the facilitation of tax evasion, companies should conduct regular risk assessments, implement appropriate controls, and establish effective compliance programs that include training employees and conducting regular audits and reviews. By taking these steps, companies can help to ensure that they are not held liable for the criminal facilitation of tax evasion by their employees or associated persons.

www.umbrellacheck.org.uk provides a complete compliance service that has been designed to help recruiters and end clients meet the “reasonable measures” threshold of the government guidance. In short with the help of Umbrella Check businesses can insulate themselves from the threat of prosecution should serious noncompliance be discovered in their supply chain.